Sex, Genes, Politics and Company Law:

Can Capitalist Democracy coexist with Human Survival?

Chris King Aug 2013 - Feb 2020 Genotype 1.1.38

PDF

For significant updates, follow @dhushara on Twitter

Fig 1: Mortal combat between the Bear and Bull stock market overlaid by the triple witching hour instability 2011.

Fireworks over Lady Liberty, Ellis Island, NY.

Contents

1. Twin Pillars with Feet of Clay in a One-Sided Love Affair

2. Sexual Conflict and Human Emergence

3. Urbanization and the Rise of Patriarchal Dominance

5. Democracy meets the 'Age of Enlightenment'

6. Capitalism, Patriarchy and Ecology

7. A Primer on Inequality, Power Laws and the Gini Coefficient

8 . The Rich Get Richer: Is Capitalism the Democratic Complement?

10. The Harder They Fall: Global Financial Crisis

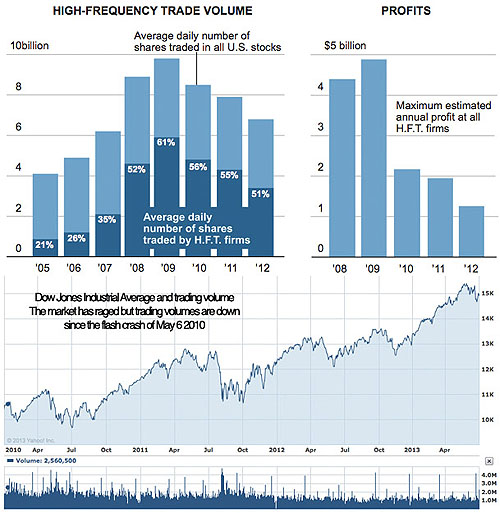

11. Quants and Light-speed: Testosterone meets Technology

12. Free Market Utopias vs Irreversible Tipping Points

13. Resilient Genetics vs Ephemeral Corporations

14. Corporate Killers and Downsizing Profitability

15. Political Genocide and Corporate Metamorphosis: Where have

all the Cod Gone?

16. Hooker Chemical and the Rape of the Love Canal

17. Abysmal Discord: Deepwater Horizon

18. We all Fall Down: Ecological Economics vs Machiavellian Intelligence

19. Ecologizing Capitalism: Company Incorporation as a

Conservation Investment

20. References

.

See also: Religion, Politics, Sexual Reproduction and the Future of Human Society

.

Twin Pillars with Feet of Clay in a One-Sided

Love Affair

The twin pillars of

Western civilization are capitalism and democracy, but are these consistent

with surviving in a living planet? Are they beneficent foundations of

individual freedom and prosperity, or are they malign forces doomed to boom and

bust instabilities that will carry us past tipping points into a hard landing

for human survival? Could they, in the face of natural abundance, bring about

economic collapse in a tragedy of the commons due to environmental disruption

caused by the human impacts they have set in motion?

While capitalism’s

money-driven investment economy has a controversial name - a Jekyll and Hyde

black and white character depending on one's pendulum point in the

ever-smouldering left-right political divide, democracy is almost universally

anointed a saintly role in the preservation of civil liberties and freedom of

choice of the people – the bedrock of Western civilization.

But this is a little

naēve? As Winston Churchill once famously said: "Democracy is the worst form of government, except for all those other

forms that have been tried from time to time." Of course he said this

ironically, after being defeated in a rebound election, having won the Second

World War, but his point is not just about the electoral vagaries of democracy

for aspiring leaders, but the intrinsic paradoxes of social government. George

Bernard Shaw highlighted the skeleton in the democratic spin closet we have to

be astute enough to see through: "Democracy

is a device that ensures we shall be governed no better than we deserve."

This article

investigates whether electoral democracy and corporate activity, lacking any

real genetic stability and prone to winner-take-all exploitation, particularly

of natural resources; able to change from a shark to a tiger by a simple act of

recapitalization; and often short-lived in a predatory merry-go-round of

relentless takeover and corporate cannibalism; driven only by the profit

imperative and the vagaries of the free market, can provide any basis for

long-term economic and ecological sustainability. We shall also examine how

both capitalism and democracy are manifestly social products of the male gender

to the exclusion of the immortal sex men live their lives to fertilize, unearth

the inevitable Machiavellian strategies of deceit that coexist in any climax

society and seek the keys to an ecological completion of the economic quest for

a life of natural abundance.

Sexual Conflict and Human Emergence

We need first to take

a step back and expose the sexual underpinnings of this entire process. In

"Sexual Paradox: Complementarity, Reproductive Conflict and Human

Emergence", we articulate the thesis that the emergence of human culture,

super-intelligence and social complexity has come about through an irresolvable

red-queen race of sexual selection, in which neither sex has had the upper

hand, leading to strategic paradox and the runaway selection of genes favouring

both male genius and female social and sexual astuteness, enhanced by mammalian

XY sexual chromosome genetics.

Fig 2: Human sexual dimorphism

at the cellular and organismic levels.

Fig 2: Human sexual dimorphism

at the cellular and organismic levels.

Central to this idea

is the primary role of female reproductive choice, rather than the

'Flintstones' - man the hunter - view of male chauvinist warriors clubbing

prospective partners, or abducting them, as still occurs commonly in some

Amazonian warrior cultures such as the Yanomamo, and in Central Asian countries

such as Kyrgyzstan. Intriguingly

both evolution of humanity through sexual selection and the dominant role of women in choosing mating partners was recognized by Charles Darwin in his second

work ‘The Descent of Man, and Selection in Relation to Sex’ after writing ‘On the Origin of Species’.

Although humans have

strong pair-bonding partnerships associated with the long child-rearing times

of humans compared with other primates, female reproductive choice remains

paramount among mammals because they bear live young and engage lactation

giving females a primary parenting reproductive investment and males a primarily

sexual fertilizing investment. The evolution of female orgasm, concealed

ovulation, counterpointed by menstruation, lunar menstrual synchrony, perpetual

sexual receptiveness associated with sexual coitus as a social means of family

bonding, the loss of the penis bone and penile spines in favour of a large

tumescent penis providing a genuine indicator of genetic fitness in men, all

point to a line of human evolution in which female reproductive choice has had

a central role. A role in driving human language and cultural emergence, in

which women gatherers chatting together in the field about their relationships,

provided the central bulk of the subsistence diet, while male hunters' meat

from the kill, gained in silent vigil, was a dietary supplement traded for

sexual favours.

Fig 3: Clockwise from top

left: Nisa, Deep trench in mitochondrial DNA extending to 140,000 years (Behar

et al), Menarche rite (Fulton’s Cave), actual eland dance for the menarche,

cave with 70,000 year old paintings (Tsolido Hills) evidence of cosmetics and

shell jewelry (Blombos Cave 75,000).

The reproductive investments of the two human sexes are diametrically opposed, with males investing primarily in sexual fertilization by many means, from cut and run through faithful husbanding to the alpha male harems of Udayama and Ghengis Khan. Women on the other hand have a major investment in parenting and have to spread their investment over the relatively few children they can give birth to. Only three percent of mammals are monogamous because of the major polarization internal fertilization, live birth and lactation precipitate and humans stand at an extreme among mammals because of the massive nature of human pregnancy, the increased risk to the mother due to the large human head and the long period of vulnerability a young lactating mother faces protecting her family.

Thus women's choices

have been driven towards resource-bearing men who are also intelligent

providers, gleaned through the social filters of good hunting, musical and artistic

ability, and good jokes and story telling around the fires during long

discussions in the night about the affairs of the human grape vine, while

occasionally outsiring on the sly to a stud with desirable genes as an

insurance against putting all her eggs in one man's basket, something all men

find a mortal threat of paternity uncertainty, but no woman faces.

Humans, like several

ape species are commonly female exogamous, with females moving to live with

their male partner’s kin. Most cultures have had patrilineal kinship, rather

than the matrilineal patterns of temporary sexual partnerships, or 'walking

marriages', with uncles helping rear their sisters offspring. Nevertheless the

social traditions of founding human cultures, such as the bushmen, show a

pattern respecting a young woman's first pregnancy and delivery being with the

maternal family, honouring the power of menarche as a sacred rite of passage

upon which the fertility of the people depends, rather than regarding women as

‘unclean’, and allowing a degree of female choice about their partnerships

surprisingly similar to the more recent achievements of modern Western cultures

after centuries of male dominance, as illustrated in Marjorie Shostak's

"Nisa".

.

Urbanization and the Rise of Patriarchal Dominance

As the gatherer-hunter way of life gave way to a combination of agriculture, invented by women gatherers, and animal husbandry and herding discovered by the men, the rise of great urban cultures was accompanied by a massive transfer of power over reproductive choice to male dominant coalitions. We can see in Sumeria the delicate association of planter Queen and shepherd King founding one of the greatest cultural flowerings in human history, ultimately giving way to male dominance, in favour of the trinity of male gods An, Enlil and Enki masturbating into the primal waters.

Fig 5: Marduk slaying Tiamat the primal chaos Goddess illustrates the rise of patriarchal dominance

Fig 5: Marduk slaying Tiamat the primal chaos Goddess illustrates the rise of patriarchal dominance

over the old order of the planter Queen.

We can see an even more tortured version of this transition in Genesis where Jacob rejects the matrilineal pattern of Laban and after seven years escapes with his flocks as the arch founding patriarch along with his two wives, one hiding the house gods, or teraphim, of the maternal family ominously under her menstrual skirts. This combined with the avowedly male invocation to "go forth and multiply", celebrated in the ritual circumcision of the male member as a token of fertility, confirms the patriarchal relationship with God, consecrated in the sin arising from Eve's cavorting with the serpent, dooming woman to be in bondage to their husbands as men were in subservience to God.

This transition is sealed in a dire warning in Judges that matrilineal patterns were giving way to a staunch patriliny. The concubine of Bethlehem-Judah is accused of 'whoring' by going back to live with her father-in-law for four months. When the Levite returned to claim her, the father-in-law kept saying to stay a little longer for six days, nigh on a week. When the couple left and turned in at Gibeath of the Benjaminites, men of Belial ask to "know the man within". In an attempt to avoid sodomy, the host offers his daughter to which they refuse. The Levite then offers his concubine. She is raped and abused all night and dies on the doorstep, while her master sleeps peacefully. He then cuts her in twelve pieces and sends them to all the coasts of Israel, setting off the Benjaminite wars. These are finally resolved in moving four hundred virgins of Jabesh-Gilead to their husbands homes, capped by the abduction of the daughters of Shiloh dancing at a festival to satisfy the remaining Benjaminite men.

Invocations against female reproductive choice are likewise enforced by dire rulings on stoning for adultery, or for losing the tokens of virginity and not crying out loud enough for someone to hear, steeped everywhere in the themes of Israel guilty of whoring against Jehovah by worshipping Asherah the goddess of natural fertility represented by a tree in the Temple and the other gods and goddesses of the Nations, on every high hill and under every green tree. Note however that Jewish inheritance still unilaterally comes through the mother, in acknowledgement of the incontrovertible truth that the child of a Jewish woman is a Jew while the child of a Jewish man could be a pretentious bastard.

We see this pattern confirmed across a swathe of urban cultures, from Assyria through Persia, Greece and Rome, also manifest in all great religions, from Judaism, through Christianity and Islam to Vishnavite Hinduism, with occasional appearances of feminine deities, from Inana through Cybele to Kali. The essential feature is the rise of male military coalitions, generally headed by a tribal warlord, given mythical or divine status by degrees, supported by a rank and file of soldiers receiving menial rewards in rape and pillage by comparison with the reproductive harems of their lords and masters.

Democracy, Patriarchy and Military Alliance

Emergence of Civilization and Fall into Patriarchal Dominion

Democracy originates from ancient Greece when established in 508/7 BC by Cleisthenes, an Athenian noble, in response to the endless struggles between conflicting tyrants of the noble families, themselves the strong men of family clans tracing their origins back into mythological antiquity. Democracy arose as a compensating antidote to these patriarchal clan struggles in the form of an electoral coalition of all the Athenian men of fighting age. In most of antiquity the benefit of citizenship has been tied to the obligation to fight war campaigns. Women, slaves and foreigners were specifically excluded, meaning only about one in ten Athenians were citizens, but still it was a fundamental innovation, resulting in the most direct form of electoral democracy in history, in which the citizens decided all policy matters directly, rather than electing representatives to form a government, and in which officials were chosen from the citizens by random lot - both being devices to bypass the back-room corruption rife in clan dealings.

Fig 4: Democracy

is a complex social dynamical system invented by Cleisthenes (Lower right) as

an egalitarian parliament of male citizens of fighting age (upper right)

directly making the decisions of government through discourse. The democratic

system does not just involve the popular assembly, but law courts, tribunals,

clan structures social agencies and the military, just as modern electoral

democracy depends on the rule of law and political accountability to function.

(Upper left): Zeus abducts his great-grandson Ganymede in an incestuous

homosexual act of paedophilia to become his lover and cup bearer on Olympus.

470 BC Temple of Zeus, Olympia. (Lower left) Priapos (god Bes) c500 BC from a

brothel in Ephesus. (Top center) Appenzell the last cantonment to give women the vote in 1990, and then only when compelled by the federal government, is one of the last two cantonments still operating the Landsgemeinde or "cantonal assembly", one of the oldest forms of direct democracy, dating from the middle ages. Eligible citizens of the canton meet on a certain day in the open air to decide on laws and expenditures by the council. Everyone can debate a question. Voting is by those in favour of a motion raising their hands. Until the admission of women, the only proof of citizenship necessary for men to enter the voting area, as in the 1971 meeting above (National Geographic), was to show their ceremonial sword or Swiss military bayonet. This gave proof that you were a freeman allowed to bear arms and to vote, pretty much exactly as in the Athenian male-military coalition model.

Notably Athenian

society was one which extolled the virtues of men above women, as noted in Eva

Keuls “The Reign of the Phallus: Sexual Politics in Ancient Athens” and Gerda

Lerner’s “The Creation of Patriarchy”.

Greece was a patriarchal class-driven society with slavery, in which

women were excluded from political life and were lifelong minors under the

guardianship of a male.

When Zeus the male

high god at the centre of the pantheon overthrows Kronos he swallows his

wife Metis thus preventing her bearing a son, in the same process, assimilating

to himself her power of procreativity. He is thus able to give birth to Athena.

We thus see not just woman but the very capacity of women to contribute to the

nature of the offspring unravelled by the patriarchy.

Woman becomes an empty

vessel for male procreativity:

"The mother is not the true

source of life.

We call her the mother, but she

is more the nurse,

The furrow where the seed is

thrust.

The thruster, the father is the

true parent:

The woman but tends the growing

plant".

Apollo in Aeschylus' "Eumenides" or

"Furies"

The idea that only the

male was procreative spilled over into excessive absorption with male sexuality

in men loving men, and 'passing on one's manhood' to under-age boys. Pederasty

was an institution sanctioned by the Olympian gods and mythical heroes. Zeus,

Apollo, Poseidon and Heracles all had pederastic experiences. So did many of

the most illustrious real-life Greeks including Solon, Pythagoras, Socrates and

Plato. The act was part of the foundation of an elitist, military culture that

elevated the idea of the penis beyond biology and religion to the rarefied

heights of philosophy and art. The pederastic act was the culmination of a

one-on-one mentoring aimed at passing on arete

a set of manly virtues including courage, strength, fairness and honesty.

Believing Anaxagoras, in a bid to father only sons, men even had their left

testicle removed.

Essentially democracy

was a patriarchal trade-off between fighting men to balance the alpha male

dominance of feudal tyranny arising from tribal clan warlords later become

urban ‘nobility’. We know that women began to gain the democratic vote a full two and a half millennia later, only at the turn of the twentieth century, when New Zealand gave women the vote in 1893, underlining the deep relationship throughout history between patriarchal dominance and democracy. Previously France had instituted universal male suffrage abolishing all property requirements to allow men to vote in 1792. Ironically woman didn't get the vote in France until 1945 and in Switzerland women gained the vote in 1971 and in cantonal elections only in 1990, underscoring how deep and long the association between patriarchal dominance and democracy has been.

But neither have individual woman leaders in this avowedly patriarchal tradition necessarily been willing or able to transform the situation for the better when in power, with leaders from Margaret Thatcher to Indira Gandhi taking the authoritarian path of the extreme right. For a time New Zealand had two alternative female leaders, both of who became prime minister. Jennifer Shipley was renowned for divisive new right policies such as dissolving family trusts to make elderly people pay for their health care, despite a national health service. Helen Clark led a labour government for three terms, which was socially conscious, but did so by holding her cabinet in line with strict alpha leadership discipline, leaving no strong contender to fill her shoes when she moved on, after losing her fourth term election, to head the UN Development Program.

The Age of Patriarchy: how an unfashionable idea became a rallying cry for feminism today.

Democracy meets the 'Age of Enlightenment'

It is this alpha male

pyramid that Athenian democracy sought to mediate, by instituting direct

democracy among the citizens of fighting age, upon whom the independence of the

city state depended. Little wonder then that democracy has been until the last

few decades a purely male affair and that in its first past the post

adversarial competing two-party form, is a veritable male reproductive combat

ritual for the winner-take-all complete spoils of the feminine partner in the

piece, the blind lady justice of the voting population.

.

Laying bare how central male reproductive combat is to democratic electoral systems, Klofstad et al. (2015) found that the deeper the voice of a contestant of either sex, the more popular they were, with the deeper voices gaining between 60 and 80% of the vote, indicating markers of testosterone dominance are more influential than a candidate's policies and trustworthiness.

In reflection of the

tendency to adversarial positions in male combat there has emerged a major

polarization in democratic politics between the right, which in its harder

forms leans to a set of patriarchal beliefs in individual enterprise for

winner-take-all gains, veering towards Fascist dictatorship of the strong

leader, in opposition to the left

and its 'nanny society' of the welfare state, more reminiscent of shared

parenting notions. On the extreme left we find again a totalitarian tendency,

turning social equality into a big brother society maintained through the

illusion of class warfare run by nepotistic cliques of one party state

officials.

In first past the post

form, democracy is prone to a tyranny of the majority in which the policies and

legislation of the winning party can act to protect the interests only of those

supporting the government in power to the exclusion, or outright detriment of

the opposing minority. The Muslim Brotherhood in Egypt is not the only

democratically elected government, which has been accused of failing to act in

the interests of their country as a whole. The problem is endemic to all first

past the post democracies.

Fig 6: (Left) Gerrymandering

and the proportional paradox (Stewart New Scientist) . (Right) An engraving

from the 1772 edition of the Encyclopédie; Truth, in the top center, is

surrounded by light (Wikipedia).

Democracy in its

modern forms is in many senses both a product and a facilitator of the age of

enlightenment. The age induced

examination of the standards by which people ruled and gave validation to the

idea of human rights. Democracy in turn became a catalyst of free-thinking

ideas and opportunities in society and commerce.

To compensate this

glaring pattern of perpetual conflict, many societies have sought to modify the

simplicity of adversarial democracy. The US federal government for example has

a written constitution and three houses President, Senate and House of

Representatives intended to provide a set of checks and balances against the

potential tyranny of any other branch. However, in practice, this seems to

create a very expensive cumbersome top-heavy governmental system prone to

intractable conflicts of government, and an opacity more easily served by

business interests and professional lobby groups than the average citizen.

Other countries have

sought to dilute the manifest reproductive combat scenario of first past the

post with various forms of proportional representation such as STV (single

transferrable vote) and particularly MMP (mixed member proportional), in which

each party adds list members in addition to their elected members to give them

proportional membership in parliament, leading to coalitions of smaller parties

and more representative forms of government. Although this advantage is parried

by a rise in back-room deals between un-elected list candidates and a tendency

to unstable alliances. MMP does serve to provide a more ecosystemic form of

democratic process, which has a greater probability of serving the interests of

diverse minorities.

Electoral theory shows that changes in the electoral system can produce almost any outcome in a closely fought election. In “Electoral dysfunction: Why democracy is always unfair”, the mathematician Ian Stewart shows that virtually all voting systems lead to paradoxes of one sort of another. First past the post ranks well in stability and accountability, but is a dud in fairness. In first past the post with several candidates a candidate can win without even getting a majority, so most votes are literally wasted. A runoff doesn’t solve this either because the two highest candidates may come from the same political side of the spectrum if there were a multiplicity of opposing candidates. Preferential voting can lead to paradox in which everyone wins because the preferential order of the voters chases its tail. MMP avoids such paradoxes but leads to list candidates and unstable coalitions of government so it is fairer but less stable and sometimes less accountable.

As

of 2018, in New Zealand we have an MMP government formed by a coalition of

three parties Labour, New Zealand First and the Greens agreed to a coalition

between the first two, in which the Greens provide confidence and supply, after

NZ First rejected a coalition with the largest party National holding 45% of

the vote, due to loss of trust between that party and NZ First. This

arrangement appears to be working well although naysayers would claim the

largest party was robbed of the right to govern. It demonstrates a refreshing

counterpoint to Trump’s divisive politics of deceit and abuse, particularly

when the Prime Minister brings her newborn child to the UN, as both a leader

and a nursing mother.

Although elections to

the US House of Representatives use a first-past-the-post voting system, the

constitution requires that seats be "apportioned among the several states

according to their respective numbers" - that is, divvied up proportionally.

In 1880, the chief clerk of the US Census Bureau, Charles Seaton, discovered

that Alabama would get eight seats in a 299-seat House, but only seven in a

300-seat House. In the

proportional paradox, increasing the total number of seats available to

balance the parties to their proportional vote can reduce the representation of

an individual constituency, even if its population stays the same because the

way the proportions are rounded down and then compensated for by an integer

number of additional seats can change the balance in the rounding so an

electorate loses representation.

Central in all these

systems is the allocation of electorate boundaries, because many elections such

as GW Bush’s first election was won against Al Gore with less than half the

popular vote. Gerrymandering, choosing election boundaries to favour a

candidate or party, is named after a 19th-century governor of Massachusetts,

Elbridge Gerry, who created a an electoral division to bias the vote whose

shape was so odd as to remind a local newspaper editor of a salamander.

Economist Kenneth

Arrow discovered one of the most fundamental paradoxes of voting. He set out

four general attributes of an idealised fair voting system - (1) that voters

should be able to express a complete set of their preferences; (2) no single

voter should be allowed to dictate the outcome of an election; (3) if every

voter prefers one candidate to another, the final ranking should reflect that

and (4) if a voter prefers one candidate to a second, introducing a third candidate

should not reverse that preference. However Arrow and others went on to prove

that no conceivable voting system could satisfy all four conditions. In

particular, there will always be the possibility that one voter, simply by

changing their vote, can change the overall preference of the whole electorate.

In many ways Winston Churchill's comment thus remains true.

In

response, given the access to information flows facilitated by the internet age, some advocates seek a return to forms of

direct democracy not interfaced by elected, or unelected party representatives.

In

a position piece on such developments in Europe, Nathan Gardells (2018) comments:

For the first time, an Internet-based movement has

come to power in a major country, Italy, under

the slogan “Participate, don’t delegate!” All of the Five Star

Movement’s parliamentarians, who rule the country in a coalition with the

far-right League party, were nominated and elected to stand for office online.

And they have appointed the world’s first minister for direct democracy,

Riccardo Fraccaro. “Referenda, public petitions and

the citizens’ ballot initiative are nothing other than the direct means

available for the citizenry to submit laws that political parties are not

willing to propose or to reject rules approved by political parties that are

not welcome by the people. Our aim, therefore, is to establish the principles

and practices of direct democracy alongside the system of representative

government in order to give real, authentic sovereignty to the citizens.”

Another participatory tool being used around the world

from Iceland to India, is “crowdlaw” - “a form of crowdsourcing that uses novel collective intelligence platforms and

processes to help governments engage with citizens. In Taiwan, the new Referendum Act that

took effect in January 2018, means the public has “more say than ever in the

country’s future.”

Running against this trend, the idea of direct

democracy has retrenched instead of advanced in the Netherlands. After a

non-binding 2016 referendum that expressed euroskeptic sentiment, the Dutch Parliament abolished the referendum law, worried that it

would lead to populism.

The

difficulty with government by referenda is that there are few safeguards

against absolute tyranny of the majority, even it is

when razor-thin, or achieved through a campaign of misinformation and foreign

interference, as with Brexit. The process is also

prone to populist sentiments, as there are no constitutional, or institutional

safeguards of accountability for the decisions made, and no moderating

influence of a governing track record to establish trust in the proposed

agenda, which could become irreversibly repressive on cultural diversity

causing diverse minorities to suffer disproportionately. However an informed

process of direct democracy could serve to complement and enrich representative

government.

Capitalism, Patriarchy and Ecology

Many features of

venture capitalism, particularly those that lead towards a tragedy of the

commons and a tipping point into climatic crisis, also display graphic features

of human reproductive imperatives - distinctively those of the spermatogenetic

reproductive strategy of males in the absence of a contravening and

complementing female long-term out-front parenting investment strategy across

several offspring and multiple generations.

Firstly capitalism is

based on monetary resources, just as male reproductive investment has a major

component of the resource-bearing male securing the sexual commitment of one or

more female partners. Classically a majority of ethnic societies are

polygynous, with a man able to secure sufficient income to support two wives

frequently doing so. Thus the

proportion of men in polygynous marriages in such societies is around one in

eight or 1/23, reflecting the inverse cube power law noted in the

distribution of capital in human societies. Thus the distribution of financial

wealth in capitalist societies is closely tied to the human male reproductive

imperative. Nowhere in natural ecosystems do we find one individual possessing

a million or a billion times the resources of another member of the same

species, except in terms of male reproductive imperatives, where an alpha male

bearing the right resources in bulk, display, fighting prowess or monetary or

military capital can capture 100% of the reproductive resources of all the

females he can command.

Other features of

capitalist investment, including winner-take-all intellectual property rights,

the tendency to short term boom and bust investment at the expense of long-term

sustainability, the reckless risk-taking preparedness to pass irreversible

tipping points unless damage is exhaustively proven in advance, all reflect the

male reproductive imperative's venture risk strategy - preparedness to die to

secure immortality - as illustrated in Matty Groves facing death to fertilize

Lady Arlen in the hope of giving birth to a prince who can have riches, the

choice of many eligible women and thus many offspring. No woman can afford to

risk her life to reproduce because she can only give birth if she IS alive.

Another patriarchal

feature of capitalist economics is an obsession with exponential growth to the

exclusion of any understanding of how to benefit long-term from inevitable

cyclic changes and non-linear feedbacks that arise in natural systems. An

exponentiating resource, by its very nature, is unsustainable long term in any

finite environment such as a planetary biosphere. While natural growth is a

feature of all living systems the universal application of exponentials to the

economic condition in terms of expectations of an endlessly increasing gross

national product as an indicator of health has parallels only with male

reproductive resource seeking. The health of an economy is not measured by

exponential growth, but by long term robustness and the quality of human life

it can sustain. An exponentiating economy, like the population explosion, is a

long-term threat to our survival through habitat destruction resource depletion

and an unsustainable dynamic that has no day after tomorrow. Economics also

needs to be able to model itself on the full suite of transcendental functions

including periodic functions sines and cosines and incorporate non-linear

feedback principles to be able to respond to fluctuating market and natural

conditions.

Steady state

economists such as Herman Daly, Richard Heinberg and Brian Czech try to make

clear that growth pursued over and above what the natural environment and

non-renewable resources can sustain is unsustainable bad economics, which may

benefit the perpetrator but overall reduces our long-term collective wealth.

However nature itself is stable amid climax diversity and natural fluctuation.

This leads to ecological economics in which the priority is modelling our

economic system on natural principles to enable society to coexist over time

with the biosphere on which we depend for our survival. Penetratingly John

Stuart Mill, one of the founders of economics, both hypothesized that the

"stationary state" of an economy was the desirable condition, and at

the same time in his work "The Subjection of Women" claimed that

society and gender construction was holding women back and that the oppression

of women was one of the few remaining relics from ancient times, a set of

prejudices that severely impeded the progress of humanity.

.

Fig 6b: Introduction to "The Subjection of Women" John Stuart Mill 1869

The prisoners’ dilemma

is a classic paradox of game theory, in which two prisoners are tempted to

defect and expose one another, and pass the blame to get off, rather than incur

a light or moderate sentence if they both cooperate and stay silent. This is a

temptation into mutual jeopardy because mutual defection causes both to get a

long prison term by ratting on one another. Virtually all strategic social

encounters in which the players endure are prisoner’s dilemma games of the

strategic competition between defection and cooperation, in which temptation

into mutual defection is a tragic outcome.

Both the classic

Tragedy of the Commons, drawn attention to by Garret Hardin, is a laissez-faire

prisoners' dilemma of mutual economic disaster in which it serves everyone who

can to pillage the commons to its extinction, because if they don't someone

else will, and the notion of "Rape of the Planet" - a male sexual

crime against Mother Nature - are manifestations of patriarchal venture

capitalism lacking a balancing long-term out-front feminine reproductive

nurturing strategy to maintain the viability of a closing circle of the

biosphere. It is this balancing strategy we need to find to avoid capitalism

threatening our economic and biological viability.

The patriarchal competitive winner-take-all investment environment in the electronic age, reflecting male spermatogenetic investment, leads to an ever sharpening set of instabilities in which instruments such as futures, originally intended as arbitrage to mediate commodity price fluctuations, themselves become heightened volatility instruments of rapid trade, leading to instabilities, especially in volatile times such as the triple witching hour - the last hour of the stock market trading session on the third Friday of every March, June, September, and December when three kinds of securities: Stock market index futures, Stock market index options and Stock options expire together.

Edmundo Braverman's blog "Go get Somebody Pregnant" has an interesting insight into the sexually charged relationship between sowing wild oats, ramped up personal debt and a competitively hungry trading drive. Commenting on an associate's incipient fatherhood honing his approach to business he notes: "It instantly brought me back to my old stockbroker days because, believe it or not, management encouraged knocking someone up all the time for this very reason. Management understood the correlation between outside pressure and increased production, and you never saw this more pronounced than when one of the guys had some girl pull up pregnant. That's [also] why they wholeheartedly supported guys getting into enormous amounts of consumer debt. you'd see a level of motivation and resourcefulness come out in them that you hadn't seen before. There was certainly no altruistic intent behind my old firm encouraging guys to have kids, but the end result was the same: increased production."

.

And there is clear

evidence from a 2008 research study in PNAS (Bryner) for sexually physiological

responses in male stock traders, whose testosterone levels soar on days they

make above average profitable trades. This has led to concern they may then

become susceptible to excessive risk taking due to a continuing rise in

hormones in the "winner effect" useful for ongoing sexual conquests

but which in a trading situation could lead to whiplash losses. However

exposure to market volatility and the resulting stress elevated cortisol

levels, potentially leading to a psychological state known as "learned

helplessness" where risk aversion may lead to stasis. In men these

opposing forces could lead to sentimental boom-bust instability. Paradoxically

another study (New Scientist 24 March 2011) has shown that both high and very

low testosterone lead to heightened risk taking, possibly for opposite reasons.

Men on the bottom of the social heap need to take risks to reproduce because

they have no other choice.

By contrast another

more recent survey by Rothstein Kass found that the few hedge funds led by

women far outperformed the global hedge fund index in 2012. The reasons

attributed to this success were that women are more averse to high risk

strategies than men making them potentially "better able to escape market downturns

and volatility" and thus make better long term investors. Author LouAnn

Lofton whose book title states "Warren Buffett invests like a Girl"

says women "trade less and their investments perform better, that they are

more realistic, that they are more consistent investors, and that they tend to

engage in more thorough research and ignore peer pressure". Notably' when

it comes to the higher risk, venture capitalist arena' women are harder to find

- just three women ranked at positions 36, 47 and 82 in the latest top hundred

'Midas list' in Forbes magazine.

However the presence

of women in prominent positions in major corporations doesn't necessarily lead

to a change in the capitalist zeitgeist any more than it has in adversarial

politics. Business as usual is built on a complex edifice of patriarchal

institutions, from company and corporate structures, through banks, commercial

law and regulatory regimes all designed to keep the flow of business as usual

operating. We cannot thus expect the appointment of Ginni Rometty as CEO of

IBM, Sheryl Sandberg to Facebook, or Marissa Mayer at Yahoo to result in iconic

qualitative changes in the way these corporations operate in the competitive

business environment.

There are also poignant lessons to be learned from the history of radical feminism, which show unbridled female-only strategies can have every bit as disquieting outcomes. Susan Faludi notes in the New Yorker that virtually every feminist who founded a radical movement was subsequently banished from the group. Shulamit Firestone was forced out of New York Radical Women after she and two associates were accused of being ‘defensive’ and ‘unsisterly.’ Marilyn Webb was forced out of Off Our Backs - because she was the only one with journalistic experience, being told 'You can’t write at all; you have to help other people', and banned from accepting public-speaking engagements. Jo Freeman was ostracized by members of the group Westside she had helped found. “There were dark hints about my ‘male’ ambitions — such as going to graduate school,” she said. Carol Giardina was ousted from her Florida group by “moon goddess” worshippers who accused her of being “too male-identified.” “I don’t know anyone who founded a group and did early organizing” who wasn’t thrown out. It was just a disaster, a total disaster.” The emerging lesbian wing browbeat Kate Millett into revealing that she was bisexual, and then denounced her for not having revealed it earlier. Millett had a breakdown and was committed to a mental hospital. Firestone, who had been denounced by feminists for violating the “We’re all equals” ethic by accepting a small book advance, when the women wanted to collectively own the copyright, and for appearing on “The David Susskind Show”, developed schizophrenia and eventually died alone in her apartment, apparently from starvation. Anselma Dell’Olio, founder of the New Feminist Theatre, in New York warned that women’s “rage, masquerading as a pseudo-egalitarian radicalism under the ‘pro-woman’ banner,” was turning into “frighteningly vicious anti-intellectual fascism of the left.” After Ti-Grace Atkinson resigned from the Feminists, a group she had founded in New York, she declared, “Sisterhood is powerful. It kills. Mostly sisters."

A broken idea of sex is flourishing: Blame capitalism 2018

In 2015, research into the comparative population diversity of maternal mitochondrial DNA and the male Y-chromosome led to an astounding contrast. Around 10,000 years ago, corresponding to the birth of agriculture, the diversity of the Y-chromosome underwent a collapse across vast areas on the human-colonized planet.

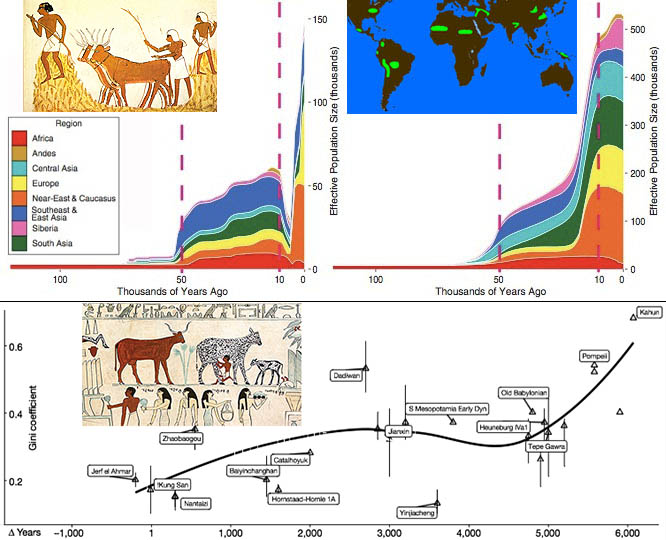

Fig 6b; Top a bottleneck in Y-chromosome diversity absent in mitochondrial DNA

inherited through the female line shows the reproductive sex ration in diverse

cultures went from an evolutionary 1 man to 2 women to 1:17 between 10000 and

5000 years ago. Bottom: Rise of the Gini coefficient

in terms of time versus advent of horticulture shows a steep rise in inequality

in the Old World associated with use of livestock.

There is no evidence this was a result of direct biological or genetic factors as there were no differences between differing Y-clades. The conclusion is that the effect was driven by cultural changes associated with agriculture in which powerful men were able to reproductively exploit large numbers of women and transmit their reproductive success on to their male heirs, squeezing the majority of males out of the reproductive race. Estimates of this phase of extreme reproductive polygyny suggest that for every reproducing male there were 17 reproductive females effectively making harems the predominant form of sexual relationship (Karmin et al. 2015).

This comes as an ironical twist since it is assumed that agriculture was an invention of women coming out of their role as gatherers in gather-hunter societies and provides a new perspective on the societies of the planter queens where female deities appear to have been worshipped at the same time as this extreme form of male reproductive elitism. The other thing that is really stunning about this effect is that it has been repeated widely across disparate world cultures, from China through the Near East to Europe and even Pre-Colombian America.

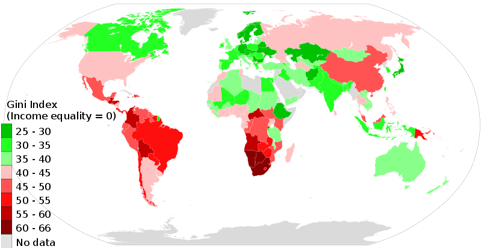

In parallel with this, is evidence for increasing inequality in large old-world urban civilizations (Kohler et al. 2017). The team worked with archaeologists around the world to collect data from 62 sites in North America and Eurasia dating from before 8000 B.C.E. to about 1750 C.E. (They also included one modern hunter-gatherer group, the !Kung San in Africa.) From the distribution of house sizes, they calculated each site's Gini coefficient, a standard measure of inequality, discussed below.

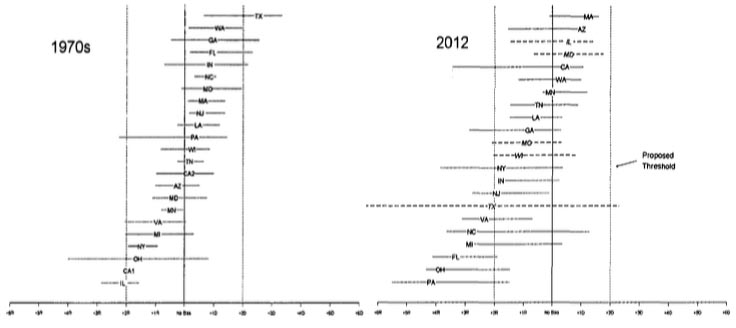

Gini coefficients range from zero, indicating that each person has exactly the same amount of wealth, to one, representing a society in which a single person has all the wealth. The researchers found that inequality tended to gradually increase as societies transitioned from hunting and gathering to farming, supporting long-held hypotheses about how agriculture intensified social hierarchies. About 2500 years after the first appearance of domesticated plants in each region, average inequality in both the Old World and the New World hovered around a Gini coefficient of about 0.35.

This figure stayed more or less steady in North America and Mesoamerica. But in the Middle East, China, Europe, and Egypt, inequality kept climbing over time, topping out at an average Gini coefficient of about 0.6, roughly 6000 years after the start of agriculture at Pompeii in ancient Rome and Kahun in ancient Egypt. The authors propose that domestic animals may explain the difference between the New World and the Old World: Whereas North American and Mesoamerican societies depended on human labour, Old World societies had oxen and cattle to plough fields and horses to carry goods and people.

Consistent with these findings, another study demonstrates that, in contrast to men, rigorous manual labor was a more important component of prehistoric women's behavior than was terrestrial mobility through thousands of years of European agriculture, at levels far exceeding those of modern women. However, humeral rigidity exceeded that of living athletes for the first ~5500 years of farming, with loading intensity biased heavily toward the upper limb. Interlimb strength proportions among Neolithic, Bronze Age, and Iron Age women were most similar to those of living semi-elite rowers (Macintosh, Pinhasi, Stock 2017 Prehistoric women's manual labor exceeded that of athletes through the first 5500 years of farming in Central Europe Sci. Adv. 2017;3:eaao3893).

A Primer on Inequality, Power Laws and the Gini Coefficient

A simple rule of thumb is that wealth is

distributed roughly as the inverse cube, so if 1 man in 8 = 23 has

enough income to support 2 wives, then a = 3 in the power law

distribution:

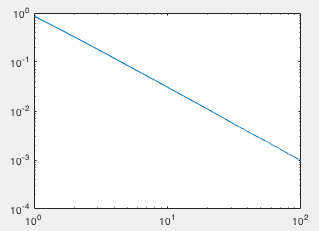

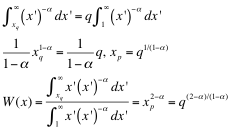

![]()

A wide range of physical, social and mathematical processes are governed by power laws. When the power, or exponent, is non-integer, they can also lead to fractal processes such as the Koch flake shown below, where each side is endlessly replaced by 4 of 1/3 the size. The power law model shows very good fit with actual data right up to the super-rich hundred or so worldwide.

It is usual to normalize the distribution so that the total probability over the population is unity:

![]()

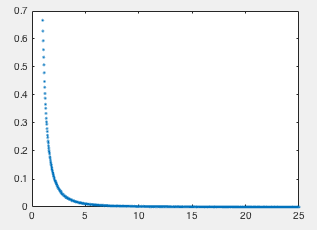

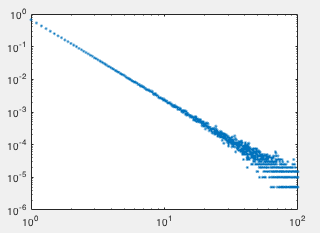

We can plot this either as a linear, or a log-log plot to show the slope has a constant power factor, as shown below:

However, as we can see, the tail of this

distribution becomes randomly erratic due to the very number small of samples in the

higher value histogram bins.

A better way of plotting is to simply plot

the cumulative probability distribution as follows:

![]()

As can be seen this has a slope exponent

shift, but gives a more accurate picture of the process.

We can model such distributions using a random

generating function, derived as the inverse function of the integral of the

distribution, where r is uniformly distributed between 0 and 1:

To

investigate the proportion of total income above a certain level xq , we proceed as follows:

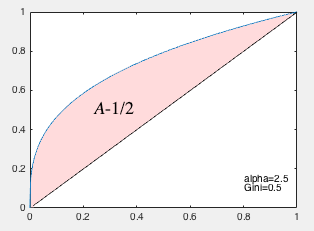

This is called a Lorenz curve after its

inventor Max Lorenz and now has a positive exponent.

To estimate inequality, a widely used

measure is the Gini coefficient, which ranges from 0

to 1, as the proportion of income which is derived from

an unequal distribution of wealth. If all people earn the same amount, the

cumulative distribution is the diagonal, so the proportion G is given by:

For our original inverse cubic example, G = 0.33. Gini coefficients have

tracked from a gatherer-hunter value of 0.18 through 0.3 in horticulture,

tracking up to 0.6 with the advent of urban civilizations and according to

recent research has reached 0.8 and 0.73 in the US and China (Wade 2017).

The way we have drawn the Lorenz curve is a

little unusual. It is usually flipped over so the high incomes are on the

right, but we can immediately see for α=2.5 that the top 10% have (0.1)(2-2.5)/(1-2.5) = 0.46, or 46% of the wealth and the top 1% have (0.01)(2-2.5)/(1-2.5) = 0.215 or 21.5% of the wealth, quite close to the figures in fig 7.

We can also invert the relationship so that

given such a 1% share, we can calculate α and hence

retrieve G, as follows:

Gini values remain somewhat inconsistent, as can be seen by comparing lower local values from the 2016 US census https://www.census.gov/content/dam/Census/library/publications/2017/acs/acsbr16-02.pdf with the higher world ones in Wikipedia https://en.wikipedia.org/wiki/Gini_coefficient.

Part of the explanation for this is that

the developed capitalist economies are not the most excessively unequal as the

world map in fig 6c indicates. In fact China on this data exceeds the US and

Southern Africa is the most unequal with many countries from Europe and Canada

to India having much lower values.

Fig 6c: World Gini coefficients as of 2014 with some figures several years out of date

Part of the reason many developed countries appear to have lower Gini coefficients is because they have better social welfare systems, which mean the lowest income brackets are not overpopulated and the income spectrum thus doesn't fit a power law distribution for the lower income end, although the power law model does hold good for higher and even the highest incomes.

For example in 2014 Oxfam released figures stating that the top 62 income earners planet wide earned as much as the bottom half put together and that the richest 1% earned as much as the rest put together. We can easily analyse these results applying the previous formulae. At a power law α= 2.15, with a Gini coefficient of 0.77, the top 62/7.2 billion will earn 0.0887of the total and the upper half will gain 0.9136, leaving 0.0864 for the lower half, very close to equal. We can also use the last formula to directly calculate that if the top 1% earn half the total income, then α= 2.17 with a Gini coefficient of 0.75.

Other figures for the top US earners appear to be a little softer. In 2000 the top 400 earned an average of $173,192,000. Given a population of 282.2m and a median income of $42,148 and a slightly higher mean of around $50,000, we arrive at α= 2.65 and G = 0.434. In 2007 the top 0.01% earned 5% of the total equating to α= 2.48 and G = 0.51.

Fig 6d: The picture emerging from US Census figures.

One definitive source of US income data is from the US Census (https://www.census.gov/topics/income-poverty/income/data/tables.html). Fig 6d shows the household income distribution as recorded for the latest year on record 2016. This data is incomplete for the very high end trends, which have been lumped together in a single pool, but it also demonstrates that income does not follow anything like a power law at the low end, due to social factors including social welfare even in strongly capitalist economies such as the US, which limit the number o very poor people, unlike developing countries like Botswana

In the second row of figures, the higher end excluding the two highest lumped bins from $95,000 to $195,000 and plotting number of people in each bracket against mean income and performing logarithmic regression, well approximates a power law fit, which gives a picture of a hardening exponent running from 2.94 in 2009 to 2.27 in 2016, with the trends in the Gini running from 0.35 to 0.65, as illustrated in black bottom left.

We can also make a rough estimate based on the top earners using the last formula above, which arrives at a much softer value of the Gini at around 0.3 throughout. This is probably an inaccurately low measure of inequality due to the crude lumping of high earners, the small sample size of 120,000 people and the fact that the survey concentrates on household incomes and poverty.

But there is another very simple way we can calculate a Gini directly, by simply constructing a cumulative income distribution by cumulatively adding up the total income in each bracket from the top down (number of people x mean income), plotting the graph, calculating the area A under it, and arriving at G=2(A–1/2). This results in a middle ground G, trending from 0.468 in 2009 to 0.48 in 2016, as shown in blue in the bottom row figures. Notice also that the empirical Lorenz curve in blue for 2016 does not have the skewed profile of the power law curve of higher incomes in black, which actually crosses the empirical plot due to the reduced number of very low incomes we have seen in the census data at the top, conflicting with the hardening power law in higher incomes, demonstrating both changing economic climates and social policies and the fact that G is independent of any particular model. This Gini calculation is consistent with the census's own figures and has been arrived at entirely empirically without any model assumptions such as a power law distribution.

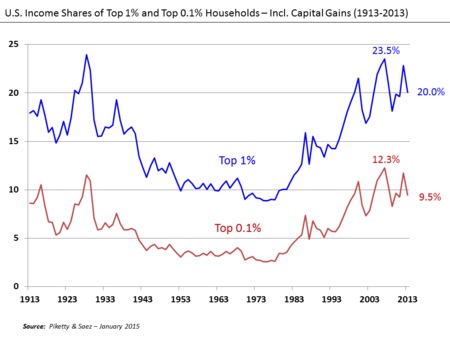

Fig 6e: Trends in top earners share in the US.

In fig 6(e) is shown independent data on trends of the top 1% and 0.1% of income earners in the US. The top 1% earning 10% and 20% tallies to α = 2.53, 3 with G = 0.48, 0.33 respectively and the top 0.1% earning 10% and 3% to α = 2.5, 3.03 with G = 0.5, 0.32. This definitely shows hardening trends, reaching historically high levels in the 2000s only seen before in the 1920s, however again the Gini estimates are not severe at face value and should only be seen as indicators of relative trends, which may actually be more severe than the sampled data, for the reasons outlined below.

Gini figures are subject to instability, both because of grainy low levels of sampling among the highest income earners and because of ambiguities of how to tally negative income at the bottom end due to debt. Both ends also tend to misreport their figures, leading to the use of relative measures, such as the Palma ratio, of the richest 10% share divided by the poorest 40% share, on the basis that middle class incomes tend to represent about half of gross national income, while the other half is split between the richest 10% and poorest 40%.

Half of England is owned by less than 1% of the population. Guy Shrubsole, author of the book in which the figures are revealed, Who Owns England?, argues that the findings show a picture that has not changed for centuries. 'Land ownership in England is astonishingly unequal, heavily concentrated in the hands of a tiny elite.'

Half of England is owned by less than 1% of the population. Guy Shrubsole, author of the book in which the figures are revealed, Who Owns England?, argues that the findings show a picture that has not changed for centuries. 'Land ownership in England is astonishingly unequal, heavily concentrated in the hands of a tiny elite.'

However all the above estimates are probably too soft, because the richest are extremely adroit at hiding their incomes in convoluted corporate dealings, opaque trusts and offshore tax havens, as the Panama and Paradise papers aptly demonstrate. The true figure is thus likely to correspond more closely with the harder G figures quoted by Chinese research, Oxfam and the UN for world values of 0.7 – 0.8, despite efforts to reduce extreme poverty in developing countries.

The Rich Get Richer: Is Capitalism the Democratic Complement?

World's witnessing a new Gilded Age as billionaires' wealth swells to $6tn 2017

This brings us back to

the testy relationship between capitalism and democracy. According to the

Oxford English Dictionary the term capitalism was first used by William

Makepeace Thackeray in 1854 in "The Newcomes". The initial usage of

the term capitalism in its modern sense has been attributed to Louis Blanc in

1850. Karl Marx and Friedrich Engels referred to the capitalistic system and to

the capitalist mode of production in "Das Kapital" in 1867. Thus

capitalism was coined by social commentators and its detractors before being

used by its free-market champions.

However the term

capitalist has an earlier usage and the phenomenon of capital investment

emerged from earlier forms of merchantilism, illustrated by city states, from

Phoenicia to Venice, and later by the colonial expansion of European nations

across the globe, from India to the Americas, in trade driven expansions

sometimes enforced by nationalistic protectionism. During the Industrial

Revolution, the industrialist replaced the merchant as a dominant actor. At the

same time, the surplus generated by the rise of commercial agriculture

encouraged increased mechanization of agriculture. Industrial capitalism marked

the development of the factory system of manufacturing, characterized by a complex

division of labor and established the global domination of the capitalist mode

of production.

The rise of democracy

in Europe in parallel with industrialization led to a notion that the two

social processes were causally interconnected. The rise of communism and the

Cold War came to entrench capitalism as a social complement and opponent of the

totalitarian manifestations of communism, as if capitalism was the bulwark of

freedom and democracy, but later developments have shown that capitalism is equally

a bedfellow of a variety of political systems, from monarchies to

dictatorships, and for example is the driving force for the rise of China as a

world superpower, despite the continued autocratic rule of the communist party

and repression of calls for democratic freedoms in China.

Fig 7: (a) The graphical data

from “Capitalism and Democracy”

2003, (b) 2007 NY Times data on income distributions in the US (Johnston), (c)

Public opposition to the US Supreme Court decision allowing unlimited anonymous

funding of political parties by corporations and unions, (d) extreme L-curve

(Lorenz curve) of income distribution Price 2003, (e) this curve remains

extreme even when the log of the income is used, showing a super-exponential

distribution.

At the same time,

capitalism has evolved from Keynesian economics to monetarism. In the tradition

of Keynesian economics, economic output is seen to be strongly influenced by

demand which does not necessarily equal productive capacity and can be

influenced erratically by a host of factors, affecting production, employment,

and inflation, requiring social adjustment. Monetarism is an alternative economic view that variation in

the money supply has major influences on national output in the short run and

the price level over longer periods, which is more compatible with

laissez-faire attitudes. As the twentieth century progressed public and

political interest began shifting away from the collectivist concerns of

Keynes's managed capitalism to a focus on individual choice.

Increasing

globalization and the formation of transnational corporations have acted to

increase the mobility of people and capital since the last quarter of the 20th

century, combining with the cementing of legally binding trade agreements to

circumscribe the room to manoeuvre of individual states in choosing national

policies and avenues of development, leading to the notion of capitalism as a

global phenomenon circumscribing the democratic political freedom of choice of

sovereign nations, while claiming to facilitate an era of greater efficiency,

prosperity and opportunity, free of barriers to trade.

In a 2003 article

celebrating the 160th anniversary of The Economist entitled

“Capitalism and Democracy” then editor Bill Emmott sets out a libertarian case for

the claim that capitalism and its freedom of enterprise and ensuing

globalization have improved living standards, reduced poverty and enhanced

productivity across the planet.

Two of his central

claims supported by graphical data are the power of liberal trade to raise

living standards, complemented by laissez-faire globalization, citing the

increase in trade surpassing GNP growth and higher growth rates in more

globalized economies (a1,2 in fig 7). He then goes on to note that the

beneficent effect of libertarian capitalism has also been accompanied by a rise

in the number of countries having nominally democratic governments, albeit

compromised to varying degrees by graft and corruption – lack of an

independent judiciary, equality before a well-enforced rule of law, and

constitutional limits on the abuse of political power.

He also makes the

claim that these processes have a causal role in alleviating world poverty: “Measured by the benchmark favoured by the

World Bank of income of $2 a day or less, adjusted to cater for differences in

purchasing power, the proportion of the worldęs population in poverty dropped

from 56% in 1980 to 23% in 2000, on Indian economist Surjit Bhallaęs

calculations [with the absolute numbers declining by a lesser 42% due to population

growth]. Before 1980, the absolute numbers were rising. That date roughly

coincides with the spread of trade and internal-market liberalisation to many

poor countries. … The truth about market liberalisation and economic growth is

not that it increases inequality, nor that it hurts the poor: just the

opposite.”

While it is well and

good that outright poverty has decreased, it is not clear whether the

relationship with laissez-faire capitalism is causal, coincidental or even 'in

spite of'. One test of this idea is to examine how income distributions have

changed, for example in some of the most laissez-faire economies such as the

US. Emmott provides only a chart entitled "bulging toward equality",

claiming middle incomes have risen steadily, if marginally, over the period,

despite periods of financial crisis and economic setback. This data is very

insensitive to both low and high incomes and presents only a marginal growth of

the middle classes of around 3% per annum.

However in 2007 David

Johnston in the New York Times showed the income gap is widening and that the

lowest 90% have seen a net decline in share from 64% to 52% in the same period,

while the top 1% have gained from 10% to over 20% by 2005, while the top 0.1%

and 0.01% have seen even more extreme increase between 2002 and 2005 (fig 7 b).

Income inequality grew

significantly in 2005, with the top 1% of Americans receiving their largest

share of national income since 1928. The top 10 percent also reached a level

not seen since before the Depression. The top 10% of Americans collected 48.5%

of all reported income in 2005, up from roughly 33% in the late 1970s. The peak

for this group was 49.3 percent in 1928. The top 1% received 21.8% of all

reported income in 2005, more than double their share of income in 1980. The

peak was in 1928, when the top 1 percent reported 23.9 percent of all income.

While total reported

income in the United States increased almost 9% in 2005, average incomes for

those in the bottom 90% of $28,666 dipped compared with the year before,

dropping 0.6%. The gains went largely to the top 1%, earning $1.1 million each,

an increase of 14%. The 0.1% and top 0.01% recorded even bigger gains in 2005

over the previous year of around 20%, largely because of the rising stock market

and increased business profits. The 0.1% reported an average income of $5.6

million, up 19.3%, while the top 0.01% of a percent had an average income of

$25.7 million, up 20.6%.

Per person, the top

300,000 Americans collectively enjoyed almost as much income as the bottom 150

million Americans receiving 440 times as much as the average person in the

bottom half earned, nearly doubling the gap from 1980. Professor Saez who

analysed the IRS data said. “If the economy is growing but only a few are

enjoying the benefits, it goes to our sense of fairness. It can have important

political consequences.”

These disparities were

confirmed in 2012 Alan Dunn’s “Average America vs the One Percent” in Forbes

magazine: “If the Occupy movement does

nothing else, it has at least introduced a new set of terms into the American

vocabulary to talk about the distribution of wealth in America. Until recently,

most average people had no idea how wealth was distributed in the country; most

people had a vague idea of a wealthy minority, but they rarely grasped the full

extent of income disparity between classes. Unequal wealth distribution is hardly a new or uniquely

American problem. In fact, it’s been prevalent throughout society since humans

first built civilizations: A small minority of aristocrats has always wielded

the most power throughout history. In modern times, America lags behind nearly

every other first-world nation in closing the gap between the classes. In fact,

we’re making it worse.”

As of his 2012 data

the average annual income of the top 1% was $717,000, compared to the average

income of the rest, of around $51,000. In net value, the 1% were worth about

$8.4 million, or 70 times the worth of the lower classes. Within this group of

people was an even smaller and wealthier subset of people, 1% of the top, or

0.01% of the entire nation, had incomes of over $27 million, or roughly 540

times the national average. Altogether, the top 1% controlled 43% of the

wealth; the next 4% controlled an additional 29%. Income disparity between the

top 1% and the other 99% was nothing compared to that within the top earners.

At the bottom of the 1% was a living wage of around $300,000. At the top of the

1 percent, people made around $5.2 to $7.5 million, with some people making closer

to a billion. This 0.1% of the country paid closer to 23% in taxes. The top 400

highest earners in the country paid only 18% personal income tax. Between 2007

and 2009, Wall Street profits swelled by 720%, while unemployment rates doubled

and home equity dropped by 35%. Since 1979, the bottom 90% has consistently

lost money while the upper classes have gained. If the average person’s wages

had kept pace with the economy since the 70s, most people would be making

$92,000 per annum by the time of writing. It is historically common for a

powerful minority to control a majority of finances, but Americans haven’t seen

a disparity this wide since before the Great Depression - and it keeps growing.

Dunn comments further:

“A common complaint against the Occupy Wall

Street movement is that it relies on “zero sum” thinking. Opponents will argue

that the wealth of the upper class should have no effect on the lower classes,

but in practice it doesn’t usually work that way. The fact is that while wealth

can be generated, money generally flows from one side of a population to the

other. While money often works its way to the upper classes, it very rarely

flows back the other way. The fact is that the upper classes really are taking

money from the poor in a very real and concrete way. The so-called trickle-down

economy has never worked, despite the protestations of conservatives. Most

extremely rich people do not spend enough money to stimulate the economy; they

save or invest their money rather than spending it. “

“Turning to the grip of capitalism on US

democratic processes it is impossible to ignore the fact that 57 members of

Congress, or roughly 11%, are members of the financial elite. Overall, 250

members of Congress are millionaires, and their median net worth accounts for

roughly nine times that of the average American. Asking politicians to enact

changes that would reduce the wealth of the upper classes is a conflict of

interests. It’s little wonder that tax cuts for the wealthy are repeatedly

enacted while the reverse is so rarely true. In order to be elected, politicians of all levels

require backing, and that backing generally comes from corporations. It’s

impossible to deny the link between politicians and corporations, and the link

is consistent regardless of a person’s political leanings. With the majority of tax income coming

in from the middle class - despite the progressive tax - and the government’s

interests clearly mingling with the upper class, is there any question of why

the income disparity continues to grow?”

This income disparity results in a super-exponential L-shaped curve for personal income, unparalleled in nature with the exception of male reproductive strategies (Price in fig 7(d)), which remains L-shaped even when plotted against the log of the income (e). Oxfam in a 2017 report provides similar L-shaped statistics for New Zealand, which according to the OECD in 2014 had a moderate Gini index of 0.333. In 2017, the top 1% own 20% of the country's wealth equating to a power law α = 2.537 and G = 0.48. But when we take the 2 top earners out of a population of 4.69 million, we get α = 2.23 and G = 0.685, again super-exponential, although both these billionaires manage trans-national corporations.

Keith Payne in "The Broken Ladder" (2017) explains that central part of the problem posed by inequality is the negative affect it has on the social climate, public health, reproductive health and economic efficiency. This is because people on the lower part of the hierarchy begin to react stressfully, to try to compensate for their underlying fear and anxiety, seeking riskier short term gains, and making less constructive decisions, such as forsaking educational opportunities which would otherwise both help them up the ladder and lead to a skilled efficient population, perceiving them to be valueless because they lead only to unachievable outcomes. Health statistics correlate tightly with inequality but less so with poverty. The factors are multiple, more self-destructive life-styles, a poorer diet, less exercise because a constructive engagement with life is perceived as not attainable. Inequality also affects neurotransmitters and hormones in a way that leads towards socially disruptive and counterproductive outcomes. These trends correlate much more tightly with inequality than with poverty, because it is not so much the direct effects of poverty on people, but the perception that the players further up the ladder are reaping rewards that are unfairly greater and there is no rational solution to the un-level playing field of inequality of opportunity.

"When people feel that tomorrow's uncertain or the resources today are scarce, they tend to focus on immediate rewards because who knows if it will still be there tomorrow?" Keith Payne/

These collateral effects can have long-term reproductive consequences. According to a study in the 1990s, those in poor suburbs, where people have harder, shorter lives, have children earlier. As life expectancy decreased, so did a women's age when they started having children. And the process is in positive feedback. Women who grow up under stress or duress begin ovulating earlier.

Payne hopes is that democracies recognise the implications of income inequality and make real moves to correct it. He believes it should be treated as a public-health problem, and addressed via policies that raise the minimum wage, expand early-childhood education and paid parental leave, cap executive pay and strengthen unions.

.

When we turn to the question of how this extreme disparity of personal income combined with massive corporate earnings influence US elections, we get into even more stormy political ground.

The dysfunctional presidency of Donald Trump is only the latest phenomenon of, and partly a product of, the very inequalities that his policies, in so far as he as been able to establish them, and those of the fractious Republican party he has manipulated, both tend and intend to accentuate. His maverick presidential bid, with the help of shadowy behind-the-scenes financial actors such as the supercomputing firm Cambridge Analytica enabled a narcissistic product of the world of privilege to falsely represent himself as a populist voice of the under-privileged, in a strategic finesse using the rust-belt electorates to achieve an electoral college win, despite a loss in the popular vote of some 3 million voters, only to institute policies from health care to tax reform that benefit only the rich to the cost of the very voters who elected him, at the same time seeking to unwind the measures to protect the planetary future in the form of decapitating the EPA and reneging on the Paris accords, setting the US on a course of selfish isolation, held in check only by the economic decline of the coal industry in the face of technological change and the concerted opposition of a coalition of US states, large corporate businesses and major cities, who seek to protect America and the planets future, constituting over half the economic and energy powerhouse of the US as a whole. An ongoing situation of systematic deceit, driven by a litany of lies, amid concerted attacks on the free press as purveyors of the very "fake news" these lies are the central expression of. But this history of gerrymandering the political realities has a longer deeper history.

In 2010 the United

States Supreme Court, in Citizens United v. Federal Election Commission, ruled

in a split 5-4 decision that the First Amendment prohibits the government from

restricting politically independent expenditures by corporations, associations,

or labor unions. The conservative lobbying group Citizens United wanted to air

a film critical of Hillary Clinton and to advertise the film during television

broadcasts in apparent violation of the 2002 Bipartisan Campaign Reform Act.

The case did not

involve the federal ban on direct contributions from corporations or unions to

candidate campaigns or political parties, which remain illegal in races for

federal office, however an ABC–Washington Post poll conducted February

4–8, 2010, showed that 80% of those surveyed opposed (and 65% strongly

opposed) the Citizens United ruling, which the poll described as saying

"corporations and unions can spend as much money as they want to help

political candidates win elections". Additionally, 72% supported "an

effort by Congress to reinstate limits on corporate and union spending on

election campaigns". The poll showed large majority support from

Democrats, Republicans and independents (fig 7c).

Despite polls and

comments from conservatives claiming support for the measure, the New York Times

stated: "The Supreme Court has handed lobbyists a new weapon. A lobbyist

can now tell any elected official: if you vote wrong, my company, labor union

or interest group will spend unlimited sums explicitly advertising against your

re-election." Journalist Jonathan Alter called it the "most serious

threat to American democracy in a generation". The Christian Science

Monitor wrote that the Court had declared "outright that corporate

expenditures cannot corrupt elected officials, that influence over lawmakers is

not corruption, and that appearance of influence will not undermine public

faith in our democracy".

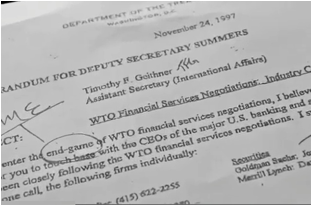

This brings into focus

the lack of full independence of the US Supreme Court from political influence.